I believe that to be an achiever, we need to be precise, methodological and consistent in our journey to the chosen destination.

In other words, be DISCIPLINED to be successful.

I practice an attractive way of incorporating discipline, which helps me successfully navigate both personal and investment lives. It is by adopting the ‘Zen’ principles.

‘Zen’ is derived from the Indian Sanskrit word ‘dhyana’, which means meditation; it is practised and applied worldwide in different ways.

The “Zen approach” emphasizes rigorous self-restraint, meditation practices, and developing honest insight into the nature of mind and things.

The supreme goals of ‘Zen practices’ are ‘enlightenment’ and an exalted state of self-awareness.

I have highlighted beneath how applying Zen Approach to Investments can help immensely in having a healthy relationship with money.

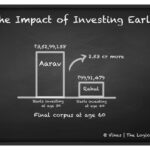

1. The early bird catches the worm

In life, never wait for the right opportunities; instead, set your goals and start immediately; with disciplined and constant efforts, you will surely reach your destination.

Likewise, for your investments, start as early as possible and let the power of compounding propel you in your wealth creation journey.

2. Inculcate Clear thinking

Develop mental strength and clarity of mind through knowledge, training and contemplation to avoid pitfalls of suboptimal judgments and faulty decisions.

Investment management is notorious for testing the clarity of mind. Stress and anxiety, if let loose, are a sure shot recipe for disaster while falling for greed and fear incite faulty buying and selling decisions.

3. Optimize what you control

Focus intensely on the variables you can control in your life and don’t waste your energy on variables outside your circle of influence; however, be prepared to take advantage of a favourable event.

In investment, too, focus on things you control like your income, budget, savings, choice of assets or adept advisor etc. However, stop fretting over interest rates, market conditions or volatility, etc.; and be vigilant to grab good opportunities.

4. Declutter your life

DECLUTTER your life of unnecessary noises, remove negativity from your life and house by cleaning them, and always be ready to accept and rectify your mistakes.

Similarly, in investments, keep your fundamentals logical and straightforward. Do not create a random aggregation of assets; instead, follow a prudent strategy.

5. Cultivate Happiness through inner joy

Limit your emotional reactions for unfavourable outcomes; instead be prepared for all situations and seek happiness from your work; learn to depend on the inner reservoir of joy.

Manage your emotions, don’t benchmark your happiness on market movements or net worth; instead, peg it on living a purposeful life; it will help you find peace and joy.

6. Set your Goals

If you do not have a plan, you will be part of somebody else’s plan; you will be regretfully lost in the hullabaloo of the world.

Investment without goals will be meaningless with a random and undisciplined approach to investments. Set SMARTER goals, have a budget and a proper financial plan.

7. Meditate

Take time to gather your thoughts, talk to yourself, gain clarity in your thoughts, and feel light and free.

Meditate to achieve the best life possible with the money you have; on your dreams and ways to accomplish those and also on the impacts that you most desperately want to bring to the world.

8. Have a mentor

In life, the role of a good mentor, teacher or coach in the success of individuals is well established.

The same goes for investments; let an expert advisor help you to take control of your financial life. It will relieve you of additional stress and free your time which you can employ in things which you are best at.

Hence, I conclude by saying that adopting the Zen philosophy can positively impact your attitude and life, and you can invest more holistically as an investor.

What do you think?

Vikas Sharma, CFP®, is a first-generation purpose-driven entrepreneur with over 19 years of experience in financial services, personal finance, and the advisory space. He is a Certified Financial Planner, an IIM Calcutta Executive Alumni, and holds an MBA in Finance and a Postgraduate qualification in Financial Planning.

Currently, Vikas is the Co-Founder & CEO of The Logical Advisor (TLA Academy Pvt. Ltd.) and Goalchi Capital Solutions LLP, where he integrates life, purpose, values, and money to create meaningful financial journeys.

He has worked with a leading Asset Management Company, mentored 1,500+ IFAs and Relationship Managers across India, and educated 10,000+ investors through Financial Wellness programs. His work has consistently focused on reshaping advisor and investor behaviour to enable sustainable success.

Vikas also coaches and mentors financial advisors nationwide, helping them build purposeful and successful careers.