Too often, we postpone financial decisions, believing there’s always more time. But in investing, time isn’t just valuable, it’s your most powerful asset.

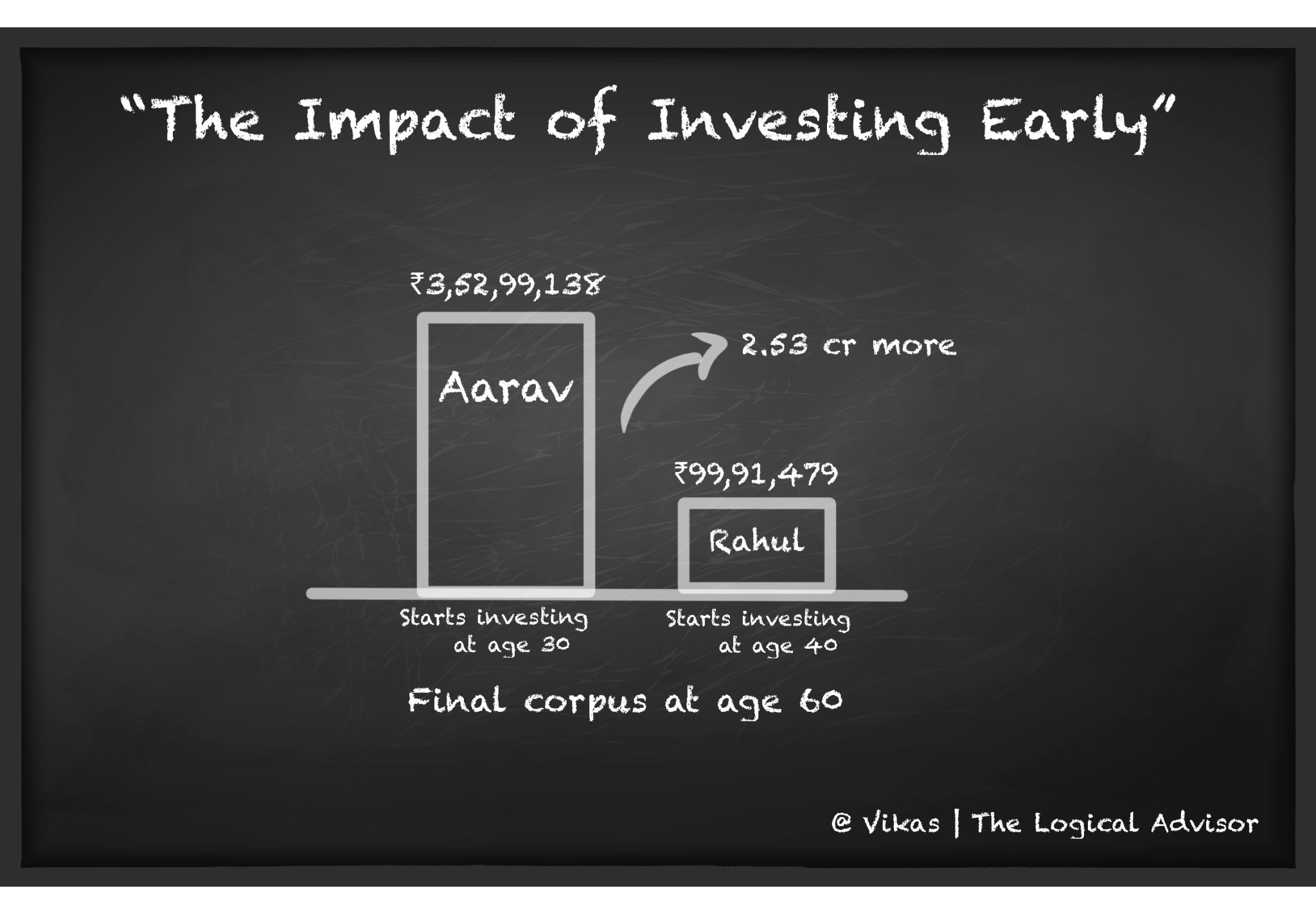

Here’s a simple real-world comparison

♦Aarav starts investing at the age of 30, ₹10,000/month SIP at 12% till 60

♦Rahul starts at 40 with the same SIP amount of ₹10,000/month

⇒At age of 60:

Aarav’s corpus: ₹3.53 Cr

Rahul’s corpus: ₹99.9 Lakh

⇒The Cost of Delay ?

₹2.53 Cr, only because Rahul waited & delayed his SIP by 10 years, thinking retirement was far away.

Total amount invested:

Aarav invested : ₹36 L (30 years)

Rahul invested : ₹24 L (20 years)

✅ Aarav invested just ₹12 L more, yet built 3.5x the wealth.

Key takeaway: Waiting for the “Right time” or just delaying often means missing the best time.

Start now, no matter what the amount is, but start.

The earlier you begin, the harder your money works & the sooner you buy your freedom.

Vikas Sharma, CFP®, is a first-generation purpose-driven entrepreneur with over 19 years of experience in financial services, personal finance, and the advisory space. He is a Certified Financial Planner, an IIM Calcutta Executive Alumni, and holds an MBA in Finance and a Postgraduate qualification in Financial Planning.

Currently, Vikas is the Co-Founder & CEO of The Logical Advisor (TLA Academy Pvt. Ltd.) and Goalchi Capital Solutions LLP, where he integrates life, purpose, values, and money to create meaningful financial journeys.

He has worked with a leading Asset Management Company, mentored 1,500+ IFAs and Relationship Managers across India, and educated 10,000+ investors through Financial Wellness programs. His work has consistently focused on reshaping advisor and investor behaviour to enable sustainable success.

Vikas also coaches and mentors financial advisors nationwide, helping them build purposeful and successful careers.