Retirement planning entails an accumulation phase and a distribution phase.

In the accumulation phase one invests during their working life to create a retirement corpus, and, this retirement corpus is then used to provide for income and other goals during the distribution phase which starts with one’s retirement.

There are mainly three strategies to generate income during the retirement period namely Systematic Withdrawals, Flooring and Bucketing strategy.

- The flooring approach involves making a safe investment portfolio to generate regular income with lowest possible volatility.

- In systematic withdrawal strategy, a diverse portfolio is created according to the retirees risk profile & needs; and then provisions are made for systematic withdrawals from that portfolio.

- The bucket approach strategy also called time segmentation strategy pioneered by Harold Evensky, is basically a way to segment your retirement period into different phases and investing accordingly in different asset classes.

My other article written on the concept of Retirement Planning – Don’t be too busy to Start will elaborate more on the concept of Retirement Planning.

The basic concept of Bucket Strategy is to divide your retirement phase into different time periods called buckets and to create an investment portfolio for each of those buckets.

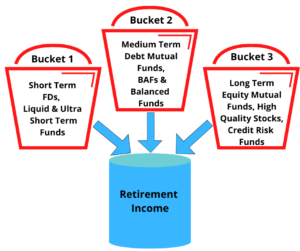

The most popular way is to divide the retirement period into three buckets:

1. Bucket 1: The initial 0- 3 years of retirement.

2. Bucket 2: The next 3- 7 years.

3. Bucket 3: The remaining years.

The Bucket 1 is designated for first 3 years of income needs and owing to short time duration, the investment for this bucket has to be made in the safest instruments with high liquidity and low volatility. The typical portfolio would contain FDs, Post office deposits, Liquid or ultra-short duration mutual funds.

The amount of money allocated to this bucket should be equal to the expense requirement of three years after accounting for pensions and other income that is available to the retiree.

The Bucket 2 is of intermediate term that they have a time period of at least 3 years or more as they would be used up after the bucket 1 is exhausted and hence the portfolio should contain debt mutual funds, High quality bonds and some equity exposure through balanced advantage funds or balanced mutual funds.

The Bucket 3 should be treated as long term as the time period for holding assets in this bucket is 7 years or more. The focus should be on growth assets to generate better returns, the portfolio should be skewed towards high quality stocks, equity mutual funds preferably bluechip or multi-caps. It could also have small allocation towards debt mutual funds like Credit Risk & Medium Term duration funds.

Many advisors believe that bucketing strategy is more of a mental accounting thing as it plays along with the biases of the individuals.

It is not that the income for first three years is generated only through bucket 1 and so on, but income is generated by all three buckets according to the portfolio performances. If there is a sudden fall in the value of say bucket 3, one has the luxury of staying invested and ride the wave of equity volatility as one is assured that his/her regular income will not be affected, bucket one is there to provide it.

This assurance helps retirees in avoiding panic state when equity market falls and prevent them from taking erratic decisions while delivering benefits of enhanced returns in the long term.

Though bucketing approach has its benefits it is not a full proof retirement income plan.

- Many research have shown that bucketing strategy do not outperform the traditional systematic approach as the portfolio rebalancing is not as efficient.

- In systematic approach where one has a portfolio comprising of different asset classes, the advisors tend to sell overvalued assets and buy cheaper assets thereby increasing the returns. In case of bucket strategy if the bucket 1 depletes the advisor has to fill that bucket by selling the holdings of other buckets which may diminish overall returns.

Customization is the corner stone of bucket strategy, therefore there is no standardized way that could serve everyone instead it requires professional planning.

In summary, Bucket Strategy has many advantages and can be a great way for many retirees to plan their retirement.

Before taking any step one should consult their financial advisor and thoroughly discuss it, before making any commitments.

Retirement has to be a blissful experience devoid of any financial worries. Every strategy has its pros and cons, it is you, your psyche, and your financial situation that dictates which strategy should be followed.

(The above article was written by Vikas Sharma, CFP, Co-Founder & CEO, The Logical Advisor)

Vikas Sharma, CFP®, is a first-generation purpose-driven entrepreneur with over 19 years of experience in financial services, personal finance, and the advisory space. He is a Certified Financial Planner, an IIM Calcutta Executive Alumni, and holds an MBA in Finance and a Postgraduate qualification in Financial Planning.

Currently, Vikas is the Co-Founder & CEO of The Logical Advisor (TLA Academy Pvt. Ltd.) and Goalchi Capital Solutions LLP, where he integrates life, purpose, values, and money to create meaningful financial journeys.

He has worked with a leading Asset Management Company, mentored 1,500+ IFAs and Relationship Managers across India, and educated 10,000+ investors through Financial Wellness programs. His work has consistently focused on reshaping advisor and investor behaviour to enable sustainable success.

Vikas also coaches and mentors financial advisors nationwide, helping them build purposeful and successful careers.