“Planning is bringing the future into the present so that you can do something about it now.” Alan Lakein

We are living in a fast-paced world where everyone is busy and has the scarcity of the most valuable commodity; time. The digital revolution has exacerbated this further by opening the gates of unlimited information on the go. In this discordant and bustling environment, significant tasks get missed or messed up; Financial Planning is one such activity. Most people consider buying a bunch of Insurances; Investing in FDs, Mutual Funds or PPF for the purpose of tax saving is all that what financial planning is. In reality, Financial Planning is a whole lot more; investment management is one important part of it and it should be done by everyone.

The process of optimally managing the financial resources of a person in order to achieve important financial goals is the basic definition of financial planning. Financial goals of a person could be the accumulation of wealth for retirement, children’s education, international vacation or buying a house, car etc. Certain goals like saving for retirement or owning a house or children’s marriage are vitally important to be ignored.

The financial plan explicitly establishes your important goals and the time available to achieve them. This helps greatly in choosing the right products for investment like if the retirement is twenty years away assigning a large portion in equity or equity mutual funds depending upon your risk profile is a sensible choice. Similarly, if your risk cover for life is inadequate, buy a suitable term plan which is cheaper instead of endowment or money back plans.

Mr. Rajeev Kumar is a senior executive in an IT company; he lives with his family of four in Gurugram. His wife Seema works as a school teacher in a private school. They have two children a boy aged 5 and a girl aged 2. Rajeev and Seema are like any other urban couple; they want to provide the best education for their children and have a pleasant retirement. To achieve these goals that they identified themselves they are regularly investing in traditional products like FDs, RDs.

Rajeev approached one of his colleagues working in the finance department of his company regarding his investments. He wanted to get some insight about investing and managing finances. His colleague insisted that consulting a professional financial advisor is a must if Rajeev is serious about his financial goals. Thereafter Rajeev and Seema did some of their own research and finally, they hired an experienced certified financial planner (CFP) as their advisor.

The analysis of the couple’s financial health by the advisor revealed that they have downplayed the role of inflation in their estimates and have all their investments in debt products, mostly bank deposits. They were shocked to know that their savings would have fallen quite short of the target amount that they may need. When dealing with future plans involving money, keeping inflation out of the picture is a grave mistake. The haphazardly done investments by them also needed a serious tweaking.

Rajeev and Seema along with their financial advisor decided that children’s education and marriage, as well as their own retirement, are the most important goals. The couple has a disposable post-tax income of Rs 2.5 lakhs per month. Their total family expenses are around Rs. 1.4 lakhs per month after which they are left with Rs. 1.1 lakhs. This residual amount of Rs. 1.1 lakhs per month if used efficiently can help the couple to achieve their desired goals.

The children’s education would cost Rs 20 lakhs for each child at present costs. After accounting for inflation the amount needed would be Rs 40 lakhs and Rs. 48 lakhs respectively for the elder and younger child. Similarly, the children’s marriages which would cost Rs. 30 lakh each at present would cost Rs. 96 lakhs for the older one and Rs. 1.15 Crore for the younger one.

The couple was very keen at maintaining their current standard of living during their retirement period. After retirement, many of the expenses may go down like children’s education costs or loan EMIs etc but newer expenses like healthcare costs will go up, so it is more prudent to take current costs as a standard. In order to maintain the current lifestyle all through the retirement period with life expectancy assumed to be 80 years for both, the couple would need to build a corpus of Rs. 12.14 crores.

All the goals of the couple are long-term in nature; therefore the advisor recommended equity as the asset class that will get the major allocation of investments. Since both Rajeev and Seema are salaried individuals, they have a monthly cash inflow and hence the most prudent way to invest in equities would be through mutual funds by way of SIP.

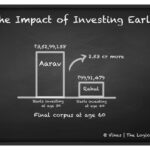

The SIP or Systematic Investment Plan is a method to invest in mutual funds regularly. The benefit of investing through SIPs are many, it inculcates discipline and a habit of saving regularly. This method of investing in equity markets is also prudent as the cost of investment gets averaged out while removing any worry of timing the market. In the longer term equity outshines all other asset classes and delivers superior returns which potently ward off any inflation risk. Starting early helps in enormous wealth creation from a modest amount as the power of compounding takes effect.

The financial Planner suggested Rajeev and Seema should invest in an assortment of mutual funds comprising of diversified, blue-chip and mid-cap funds. The table below mentions the monthly investment required for each of the goals. The total monthly SIP of Rs. 1.04 lakhs would be enough for all their stated goals.

| Present Cost of the Goal | Expected Future Cost of the Goal | Monthly Investment Required (Rs.) | |

| Children Education | |||

| Older | 20 Lakhs | 40.24 Lakhs | 12,613 |

| Younger | 20 Lakhs | 47.93 Lakhs | 9,594 |

| Children marriage | |||

| Older | 30 Lakhs | 96.21 Lakhs | 9,726 |

| Younger | 30 Lakhs | 1.15 Crore | 7,857 |

| Retirement | 12.14 Crore | 64,639 | |

| Total | 1,04,429 |

Inflation is assumed to be 6% p.a. and return on equity mutual funds assumed at 12% p.a.

The good financial plan puts before you the measurable goals, which you along with your advisor can evaluate periodically. You can see where you need to cut expenses and where you need to deploy more resources. If you ignore having a good financial plan, you are consciously driving yourself into the realm of randomness and chaos which may result in stressful, anxious and lower quality of life. By design, a financial plan is tailor-made for you, and so automatically it is consistent with your psyche and expectations, maximizing your overall well-being.

Vikas Sharma, CFP®, is a first-generation purpose-driven entrepreneur with over 19 years of experience in financial services, personal finance, and the advisory space. He is a Certified Financial Planner, an IIM Calcutta Executive Alumni, and holds an MBA in Finance and a Postgraduate qualification in Financial Planning.

Currently, Vikas is the Co-Founder & CEO of The Logical Advisor (TLA Academy Pvt. Ltd.) and Goalchi Capital Solutions LLP, where he integrates life, purpose, values, and money to create meaningful financial journeys.

He has worked with a leading Asset Management Company, mentored 1,500+ IFAs and Relationship Managers across India, and educated 10,000+ investors through Financial Wellness programs. His work has consistently focused on reshaping advisor and investor behaviour to enable sustainable success.

Vikas also coaches and mentors financial advisors nationwide, helping them build purposeful and successful careers.